Buying a home on Bainbridge

- Filter by

- Categories

- Tags

- Authors

- Show all

- All

- Activities

- Beyond Bainbridge

- Coffee

- Community

- Events

- Happy hour

- Home Tours

- Homes

- Listing

- Market Trends on Bainbridge Island

- Miscellaneous blog post

- Moving

- Neighborhoods

- Open Houses

- Parks

- Personal

- Photos

- Real Estate Business

- Restaurant

- Schools

- Shopping

- Top 10 Homes

- Top 5

- Uncategorized

- All

- 10 Free Kid-Friendly Activities on Bainbridge Island

- 1303 Kings Place NW Bainbridge Island

- 1st Saturday Breakfast at Farm Kitchen

- 2008 FHA loan limits

- 2009 Bainbridge Island Home Sales. New Homes Bainbridge Island

- 2009 FHA loan limits

- 2010 Bainbridge Island Musical Fire Truck Schedule

- 2010 Bainbridge Island Real Estate

- 2010 Housing Data for Bainbridge Island

- 2011 Bainbridge Island Chilly Hilly

- 2011 Polar Bear Plunge Bainbridge Island

- 2012 Bainbridge Island Real Estate

- 2012 Market Update Bainbridge island

- 2012 Summer Sales on Bainbridge Island

- 2013 Bainbridge Island Housing Market

- 2013 Bainbridge Musical Christmas Fire Truck schedule

- 2013 Holiday Bainbridge Island

- 2013 Real Estate Market Bainbridge Island

- 2016 Bainbridge Island Market Update

- 2016 Bainbridge Island Real Estate

- 2021 Bainbridge Island Real Estate Market Predictions

- 2022 Bainrbidge Island Predictions

- 2023 Housing Market Bainbridge

- 4th of July Bainbridge

- 5150 North Tolo Road

- 5795 Wimsey Lane NE

- 6773 NE Sid Price Road Poulsbo

- 8347 Sumanee Place NE Bainbridge Island WA

- 9175 Ferncliff Ave NE Bainbridge Island

- 9446 Coral Ct.

- Ace

- Ace Hardware on Bainbridge Island

- Acreage on Bainbridge Island

- Active Listings Bainbridge Island

- Activities on Bainbridge Island

- Adam and Eve

- Adjusting to live in the Pacific Northwest

- ADU on Bainbridge Island

- Al Gore

- Allcomers

- Ann Taylor

- Ann Taylor Loft

- Annual Events on Bainbridge Island

- Apple II

- Bainbidge Island shopping

- Bainbrdge Island Grand ole 4th of July

- Bainbridge agent

- Bainbridge Allcomers Bainbridge Self Storage

- Bainbridge Bakers

- Bainbridge Broker

- Bainbridge Bubble

- Bainbridge Buyer's Agent

- Bainbridge Buying trends in 2011

- Bainbridge Christmas activities

- Bainbridge Christmas Fire Truck 2013

- Bainbridge Christmas in the Country 2016

- bainbridge christmas tree farms

- Bainbridge Christmas Truck 2015

- Bainbridge Fire Department

- Bainbridge Gardens

- Bainbridge Gardens Pumpkin Walk

- Bainbridge High School

- Bainbridge High School Grads

- Bainbridge Holiday fire truck 2014

- Bainbridge Home Prices

- Bainbridge homes

- Bainbridge Homes on Acreage

- Bainbridge Housing Bubble

- bainbridge housing market 2009

- bainbridge housing market 2012

- Bainbridge Housing Trends

- bainbridge island

- Bainbridge Island 2014 Real Estate Market

- Bainbridge Island 2023 Real Estate Market

- Bainbridge Island 4-H

- Bainbridge island 4th of July

- Bainbridge Island Agent

- Bainbridge Island Allcomers

- Bainbridge Island Architecture Tour

- bainbridge island bikely

- Bainbridge island blueberry co

- Bainbridge Island Broker

- Bainbridge Island Builders

- Bainbridge Island Buyer's agent

- Bainbridge Island Christmas Trees

- Bainbridge Island Community

- Bainbridge Island Community Spirit

- Bainbridge Island Farmer's Market

- Bainbridge Island Farms

- bainbridge island ferry

- Bainbridge Island Fire Department

- Bainbridge Island Fire Department 2013

- Bainbridge Island FIre Department Pancake Breakfast

- Bainbridge Island first time buyers

- Bainbridge Island Foreclosures

- Bainbridge Island Golf

- Bainbridge Island Grand Old Fourth

- bainbridge island grand ole fourth

- Bainbridge Island harvest fair

- Bainbridge Island Harvest Fair 2010

- Bainbridge Island Holiday Music Fire Truck

- Bainbridge Island Holiday Shopping

- Bainbridge Island Holiday Traditions

- bainbridge island home prices

- Bainbridge Island home prices 2014

- bainbridge island home sales

- Bainbridge Island Home sales 2008

- bainbridge island homes

- Bainbridge Island Housing Market

- Bainbridge Island Housing Market 2007-2010

- Bainbridge Island Housing Market 2010

- Bainbridge Island Housing Market 2016

- Bainbridge Island Land Trust

- Bainbridge Island Lifestyle

- Bainbridge Island Listing Agent

- Bainbridge Island Listing Expert

- Bainbridge Island listings

- Bainbridge Island Little League

- Bainbridge Island Low Inventory

- Bainbridge Island Market Analysis

- Bainbridge Island Market info

- Bainbridge Island Market Stats

- Bainbridge Island Market trends

- Bainbridge Island Matthew Gardner

- bainbridge island mortgage

- Bainbridge Island Mortgage Interest Rates

- Bainbridge Island Musical Fire Truck 2013

- Bainbridge Island Musical Fire Truck Schedule 2011

- Bainbridge Island Musical Fire Truck Schedule 2015

- Bainbridge Island Musical Firetruck 2016

- Bainbridge Island Neighborhoods

- Bainbridge island Newcomer

- Bainbridge Island Newcomers

- Bainbridge Island Park

- Bainbridge Island Parks

- Bainbridge Island Parks and Recreation

- bainbridge island performing arts

- Bainbridge Island Polar Bear Plunge

- bainbridge island public library

- Bainbridge Island public school

- Bainbridge Island Pumpkin Patch

- Bainbridge Island Ral Estate Market

- Bainbridge Island Real Estate

- bainbridge island real estate expert

- Bainbridge Island Real Estate Market

- Bainbridge Island Real Estate Market Trends

- Bainbridge Island Realtor

- Bainbridge Island recent sales

- Bainbridge Island Relocation

- Bainbridge Island Relocation Expert

- Bainbridge island relocation specialist

- Bainbridge Island Rotary Sale

- bainbridge island rowing

- Bainbridge Island School District

- Bainbridge Island Schools

- Bainbridge Island sports

- Bainbridge Island Tasting Rooms

- Bainbridge Island Top Buyers Agent

- Bainbridge Island Traditions

- Bainbridge Island Trails

- Bainbridge Island weather

- Bainbridge Island with kids

- Bainbridge Island Writer's Community

- Bainbridge Islnad Commercial Real Estate. Commercial for lease Bainbridge Island

- Bainbridge Listing Agent

- Bainbridge Market Predictions

- Bainbridge Pumpkin Walk

- Bainbridge Real Estate

- Bainbridge Real Estate Expert

- Bainbridge Real Estate Prices

- bainbridge real estate trends

- Bainbridge Relocation

- Bainbridge Review

- Bainbridge Rotary

- bainbridge rotary auction

- bainbridge santa photos 2014

- Bainbridge Schools Foundation

- Bainbridge to Seattle ferry commute

- Bainbridge Top Agent

- Bainbridge Top Producer

- Bainbridge traditions

- Bainbridge Waterfront homes

- Bainbridge with Kids

- Bainbrige Island trails

- Bainrbidge island buyers agent

- Banana Republic

- Bank owned on Bainbridge

- Battle Point Park Bainbridge Island

- Bay Hay and Feed

- BC J Architecture

- Beach Access on Bainbridge Island

- Bella Luna Pizza

- Best agent on Bainbridge

- Best Bainbridge Agent

- Best Bainbridge Broker

- Best Bainbridge Buyer's Agent

- Best Bainbridge Buyers Agent

- Best Bainbridge Island

- Best bainbridge island agent

- Best Bainbridge Island Broker

- Best bainbridge island buyer'

- Best Bainbridge Island buyer's

- Best Bainbridge Island buyer's agent

- Best Bainbridge island listings agent

- Best broker on Bainbridge

- Best Buyers agent

- Best Buyers Agent Bainbridge

- Best Buyers Agent Bainbridge Island

- bible study

- Big Chocolate Chip Cookie Recipe

- Blackberry Muffin Recipe

- blackbird bakery

- Blackbird Bakery on Bainbridge

- Blakely Elementary School

- Boat launches on Bainbridge Island

- bob grimm

- Boundy Farm

- Bremerton Ferry

- Burke-Gilman Trail

- Business Cards

- Buy now or wait?

- buy or rent

- Buy or Rent on Bainbridge

- Buyers agent on Bainbridge Island

- Buying a home at Auction

- Buying a home on Bainbridge

- Buying a home on Bainbridge Island

- Buying a house on Bainbridge Island

- Buying a rental investment home on Bainbridge Island

- buying on bainbridge island

- Buying trends in 2010

- Calder Exhibit

- calico cat

- California to Washington Relocation

- Camping on Bainbridge Island

- Captain Blakely Elementary

- CaringPages.org

- Casey Roloff

- Century 21

- Changes to Washington State Agency Laws Real Estate

- Charming homes on Bainbridge Island

- children

- Chilly Hilly 2011 Bainbridge

- Chilly Hilly 2012

- Chilly Hilly Map Bainbridge Island

- Christmas activities on Bainbridge

- Christmas in Winslow 2015

- Christmas on Bainbridge

- Christmas on Bainbridge Island 2011

- Christmas on Bainbridge Island 2016

- Christmas Tree Farms on Bainbridge Island

- Christmas trees Bainbridge

- Christmas Trees Kitsap

- christmas truck bainbridge 2014

- church

- Churchmouse Yarns and Teas

- City of Bainbridge Island

- Classes at Bainbridge Gardens

- Cliff Mass Weather Blog

- Coastal Living Magazine

- commission

- Commodore Neighborhood

- Community Events on Bainbridge Island

- community on bainbridge island

- Commuting by bike and ferry Bainbridge Island

- Condos on Bainbridge Island

- Conservation Easments

- Cool homes on Bainbridge

- Corn Maze Kitsap

- Costo

- Craigslist

- crew on bainbridge island

- CSA Bainbridge

- CSAs Bainbridge ISland

- CSAs on Bainbridge Island

- Dan Budiac

- dancing paint

- Day trip Bainbridge Island

- Day Trip to Bainbridge Island

- Day Trips from Bainbridge

- Day Trips from Bainbridge Island

- Demographics Bainbridge

- Derby Downs Bainbridge Island

- Dining with views Bainbridge

- downsize

- Eagle Harbor Bainbridge

- eagle harbor books

- Episcopal

- Events at IslandWood

- expanded tax credit

- Experience broker bainbridge

- Exploring Bainbridge Island

- faith

- Fall on Bainbridge Island

- Falling for Bainbridge

- Family

- Farm Dinner on Bainbridge Island

- Farm Food Bainbridge

- Farm Fresh Bainbridge Island

- Farm Kitchen

- Farm Kitchen in Poulsbo

- Farmer's Market Bainbridge Island

- Farms Bainbridge Island

- Farms on Bainbrige Island

- Fay Bainbridge State Park

- Ferry close neighborhood bainbridge

- FHA loan limit Kitsap County

- FHA Loan Limits 2011 2012 Kitsap

- Field's End

- Finding a home on Bainbridge

- Fine homes on Bainbridge Island

- Fire Truck Christmas Bainbridge 2013

- first time buyer's credit

- first time buyers tax credit

- first time home buyers tax credit

- foreclosure

- Fort Ward

- Fort Ward Neighborhood on Bainbridge Island

- Fort Ward State Park

- Free things to do Bainbridge

- Free things to do on Bainbridge Island

- Fresh Food on Bainbridge Island

- Fresh Produce Bainbridge Island

- Friends of the Farm

- Frontdoor.com

- Gardner Report

- Garth Stein

- Gasworks Park

- Girl Scout Cookies

- Girls Night Out Winslow Bainbridge Island 2010

- Good Chilly Hilly Map

- grand forest

- Greatschools.org

- Green real estate

- Groceries on Bainbridge

- Haley Loop

- Hansel and Gretel 2012 BPA

- Harmony Acre Farms

- Hay rides Bainbridge

- healthy food

- Helicopter Bainbridge

- Helpline House

- Helpline House Bainbridge Island

- HeyDay Farm Bainbridge Island

- Hillandale Homes

- Historic homes Bainbridge Island

- Holiday events bainbridge 2014

- Holiday events Bainbridge island

- Holiday Events on Bainbridge Island

- Holiday Winslow 2012

- Home buying on Bainbridge Island

- Home Depot

- Home Grown Dinner Bainbridge

- Home on Bainbridge Island

- Home Prices on Bainbridge

- Home prices on Bainbridge Island

- Home sales bainbridge island 2014

- Home Tours

- Home tours on Bainbridge Island

- Homes close to ferry bainbridge

- homes for sale on Bainbridge Island

- Homes in Winslow

- Homes on Bainbridge Island

- Homes Winslow

- Homes with character on Bainbridge Island

- Horse Property on Bainbridge Island

- Houseboats on Lake Union

- Housing

- Housing Inventory on Bainbridge Island

- Housing on Bainbridge Island

- how to win a bidding war on Bainbridge Island

- How's the Bainbridge Island Market?

- HUD

- IKEA Hacker

- Investment opportunity Bainbridge

- island crossings

- Island Wine Weekend Bainbridge

- islandmoms

- Islandwood

- IslandWood on Bainbridge

- IslandWood on Bainbridge Island

- It's Lovely ill Take it

- J.Crew

- jen pells

- Jen Pells Bainbridge Broker

- Jen Pells Bainbridge Windermere Agent

- Jen Pells Real Estate

- Jennifer Pells

- Jennifer Pells Broker Bainbridge

- Jerry Reese

- Jim Whiting

- John Jacobi

- Johnson Farm on Bainbridge

- Kennedy and Kate

- kids

- Kids on Bainbridge Island

- Kim McCall

- King County

- Kisap county assessor

- kitsap christmas tree farms

- kitsap condo market

- Kitsap County

- Kitsap County Christmas Tree Farms

- Kitsap County Foreclosures

- Kitsap county real estate sales pendings

- Kitsap Farms

- Kitsap Pumpkin patch

- Kitsap Pumpkin Patches

- Kitsap real estate

- Kitsap Sun

- Kitsap Waterfront Homes

- LA times

- Land for sale on Bainbridge Island

- LEED

- Let's Go Sailing Seattle

- Liberty Bay

- lien

- Life Flight Bainbridge

- Life on Bainbridge Island

- Life with kids on Bainbridge Island

- Listing a home on Bainbridge Island

- Listing Agents on Bainbridge Island

- Listings on Bainbridge Island

- Little and Lewis Bainbridge Island

- Live Music Bainbridge Island

- Live music on Bainbridge Island

- Living on Bainbridge

- Living on Bainbridge Island

- Living on Bainbridge Island and commuting to Seattle by ferry

- Living on Bainbridge with kids

- Local Food Bainbridge Island

- Local Food on Bainbridge Island

- Local spots bainbridge island

- Low bank waterfront on Bainbridge Island

- Low Tide on Bainbridge

- Luxury homes on Bainbridge Island

- Lynwood Center

- Lynwood Theatre

- Lytle Beach

- Lytle Beach Bainbridge

- Mac II

- Madrone Village on Bainbridge Island

- Manzanita Bay

- Maps Bainbridge

- Market Data Bainbridge Island

- Market Trend Bainbridge island

- Market Trends 2024 Bainbridge

- Market Update Bainbridge iSland

- Marketing

- marone village

- Marshall strawberries

- Marshall Strawberries Bainbridge

- Matthew Gardner

- Matthew Gardner Windermere

- May Day at the Hilltop

- Median Price on Bainbridge Island

- Medical Care on Bainbridge

- Mendocino

- mid century modern on bainbridge island

- Midden Point

- Modern Homes on Bainbridge Island

- modern rambler on Bainbridge

- mom's night out

- Money Magazine Bainbridge Island

- mora ice cream

- Mora Iced Creamery

- Mora Iced Creamery Kingston

- Mortgage Bankers Association

- Moving to Bainbridge

- Moving to Bainbridge Island

- moving to bainridge island

- moving with kids

- Mt. Rainier

- Musical Fire Truck 2013

- musical fire truck bainbridge 2014

- Musical Fire Truck Bainbridge Island 2012

- NAR

- Neighborhoods on Bainbridge Island

- Neighborhoods on Bainbrigee Island

- New Construction on Bainbridge Island

- New home on Bainbridge Island

- New listing on Bainbridge

- New Listing on Bainbridge Island

- new listings on bainbridge island

- New to Bainbridge

- New to Bainbridge 2017

- New to Bainbridge Isand

- New to Bainbridge Island

- Nickel Bros Home movers

- Night Life Bainbridge Island

- Nikon D60

- North Hill Neighborhood

- North Town Woods

- North Town Woods Auction

- North Town Woods Neighborhood Bainbridge Island

- Northwest Newcomers

- NWMLS

- NY Times Haven

- Obama home tax credit

- One level living in Winslow

- Open Houses on Bainbridge Island

- Open Trail on Bainbridge Island

- Open Trails at IslandWood

- Outstanding in the Field

- pacific northwest title

- Pane d' Amore Bakery

- Parks on Bainbridge Island

- Paws of Bainbridge Island

- Persephone Farm Bainbridge

- Peter Brachvogel

- Photos of Bainbridge Island

- places to eat with kids Bainbridge Island

- Pleasant Beach Village

- Point White

- Point White Dock

- Point White Pier

- Point White Pier on Bainbridge

- Point White View home

- Port Gamble

- Pottery Barn

- Poulsbo

- Poulsbo Farm Kitchen

- Premier Properties on Bainbridge Island

- Price per square foot on Bainbridge Island

- pritchard park

- private school

- Project Backpack Bainbridge Island

- Project Happy Holidays

- Project Wishbone

- property taxes

- Public Site tours at islandwood

- Pumpkin mazes Kitsap

- Pumpkin Patches on Bainbridge Island

- Pumpkins on Bainbridge Island

- Rambler on Bainbridge

- real estate

- Real estate on Bainbridge Island

- reality of bainbridge island ferry commute

- Realtor Cards

- Recent Sales

- Recent sales on Bainbridge Island

- Redfin Seattle

- REI Seattle

- Relocating to Bainbridge Island

- relocating with kids

- Relocation

- relocation bainbridge

- Remodel on Bainbridge Island

- Rentals on Bainbridge Island

- Restaurants on Bainbridge Island

- Rick Da Barros

- Rockaway Beach

- Rolling Bay

- Rolling Bay Cafe\'

- Rolling Bay Land Co

- running on bainbridge

- Running trails on Bainbridge Island

- Safeway

- Sailing on Bainbridge Island

- Sales on Bainbridge Island

- Santa Photos 2013 Bainbridge

- sawan thai kitchen

- Sawatdy Thai

- Sawzall

- Schools on Bainbridge Island

- seabreeze

- Seabrook

- Seabrook WA

- Seatte Times

- Seattle and Bainbridge Home Prices

- Seattle Aquarium

- Seattle Art Museum

- Seattle Children\'s Theatre

- Seattle foreclosure

- Seattle Housing Market

- Seattle Housing Market 2023

- Seattle Public Library

- Seattle Real estate market Trump

- Seattle to Bainbridge ferry commute

- Seinfeld

- Selling a home on Bainbridge

- Sells Patience

- September 11th IslandWood

- Seth Godin

- Shingled Homes Bainbridge

- Shop Downtown Winslow

- Shopping food Bainbridge Island

- Shopping in Winslow 2017

- Shopping on Bainbridge Island

- Shopping Winslow 2012

- short sale

- Short sales

- Short Sales on Bainbridge Island

- Silverdale

- Simply Recipes

- Sleepless in Seattle Houseboat

- Small Business Saturday Winslow 2017

- Smith Brother\'s Farm Milk

- Soccer fields on Bainbridge Island

- Sound Food

- Special Homes on Bainbridge Island

- Sports on Bainbridge Island

- spring forward

- Standard and Poor's

- Stanfor

- Starbucks

- Stetson Ridge

- Strawberry Hill Park on Bainbridge Island

- Streamliner Diner

- suburban home

- Summer Bainbridge 2014

- Summer on Bainbridge Island

- Summer Real Estate 2016

- summer real estate stats

- Sunrose Lane

- Sunset

- Suyematsu Farm

- Suyematsu Pumpkin Patch

- Suyematsu Pumpkin Patch on Bainbridge

- Sweet Deal Clothing

- Tani Creek Farm

- Tani Creek Farms

- Tardy

- The 400

- The Art of Racing in the Rain

- The Bainbridge Island Chamber of Commerce

- The Beach House Restaurnat Bainbridge

- The Edge Improv

- The Gap

- The Grand Forrest on Bainbridge Island

- The Perfect Little House Company

- the treehouse cafe

- The Weather of the Pacific Northwest

- Things to do Beyond Bainbridge Island

- Things to do in the fall on Bainbridge island

- things to do in the summer bainbridge island

- Things to do in the summer on Bainbridge

- things to do in the summer on bainrbidge

- Things to do in Winslow 2017

- Things to do on Bainbridge

- Things to do on Bainbridge Island

- things to do on Bainbridge kids

- Things to do on Bainbridge Summer

- Things to do Seattle Weekends

- Things to do with kids bainbridge

- Things to do with kids Bainbridge Island

- Things to do with kids in the summer on Bainbridge

- Things to do with kids kitsap

- Things to do with kids on Bainbridge

- Things to do with kids on Bainbridge Island

- Things to do with kids on Bainbridge island summer

- tips for sellers

- Top agent bainbridge island

- Top bainbridge agent

- Top Bainbridge agents

- Top Bainbridge Broker

- Top Bainbridge island Agent

- Top Bainbridge Island Buyers Agent

- Top Bainbridge Listing Agent

- Top Buyers Agent Bainbridge

- Top homes on Bainbridge Island

- Top Producer Bainbridge Island

- Top rated Bainbridge Agent

- top realtor on bainbridge

- Top Ten Homes

- Top5Posts

- Tour de Coop

- Town and Country Market

- Trails on Bainbridge Island

- transitions

- Tree farms Bainbridge

- Tree Farms Kitsap

- Tree lighting 2013 Bainbridge

- Tree Lighting Bainbridge 2017

- Tree lighting Bainbridge Winslow 2012

- Treehouse Cafe

- U-Cut Christmas Tree Farms Bainbridge Kitsap

- U-cut flowers Bainbridge

- U-cut Trees Bainbridge

- U-pick berries Bainbridge

- Unique homes on Bainbridge Island

- Urget Care Bainbridge

- US Census Bureau

- USDA Kitsap

- Video of Williams Auctiton

- Volvo

- WA

- Wagfest

- Walkable to Winslow

- walks on Bainbridge

- Walks on Bainbridge Island

- Warm 2012 Seattle

- Washington Foreclosure Rate

- Washington Post

- Washington Real Estate

- Water Front Trail Map Bainbridge

- Waterfront home sales up in Kitsap

- Waterfront home sales up on Bainbridge Island

- Waterfront homes on Bainbridge Island

- Waterfront marker on bainbridge island

- waterfront on bainbridge island

- Waterfront Restaurants Bainbridge

- Waterfront Trail Bainbridge Island

- Weekend Trips Bainbridge

- Weekend trips from Seattle

- What to do on Bainbridge with kids

- what's it like to live on bainbridge island

- What's life like on Bainbridge Island

- Where to find Christmas Trees Bainbridge

- Where to find eggs on Bainbridge Island

- White Farmhouse Bainbridge

- Wilkes Elementary

- Windermere

- Windermere Bainbridge

- Windermere Bainbridge Island

- Windermere Bainridge

- Wine on Bainbridge Island

- Wineries on Bainbridge Island

- Wing Point Country Club

- Wing Point Golf Course

- Wing Point Neighborhood on Bainbridge Island

- Winslow holiday passport 2015

- Winslow Holiday Shopping 2017

- Winslow Holiday Tree lighting 2015

- Winslow Holidays 2017

- Winslow homes for sale Bainbridge

- Winslow Neighborhoods

- Winslow Paint Company

- winslow way

- Winter in the Northwest

- Woodward Middle School

May 20, 2012

May 20, 2012

Things have been sort of crazy in my world. 2006 crazy. Crazy like multiple offers and 70 hour work weeks. Crazy like I had four inspections this week, submitted three offers – all three of which were multiple offer situations and I had two families in from out of state […]

Do you like it?

May 4, 2011

May 4, 2011

First Quarter on Bainbridge Island First Quarter is officially in the history books. I personally had the busiest winter on record. I was too busy to let the dreadful winter weather get me down. That was a good thing. But, the sun is shining as I type and spring […]

Do you like it?

October 21, 2010

October 21, 2010

Categories

At our office meeting this week, my Managing Broker, Casey McGrath brought up an article about how a broker in San Jose, Lisa Blaylock, had an appealing philosophy that got her clients to look at the market with a new set of lenses – and ultimately got fence-sitters to hop […]

Do you like it?

October 8, 2010

October 8, 2010

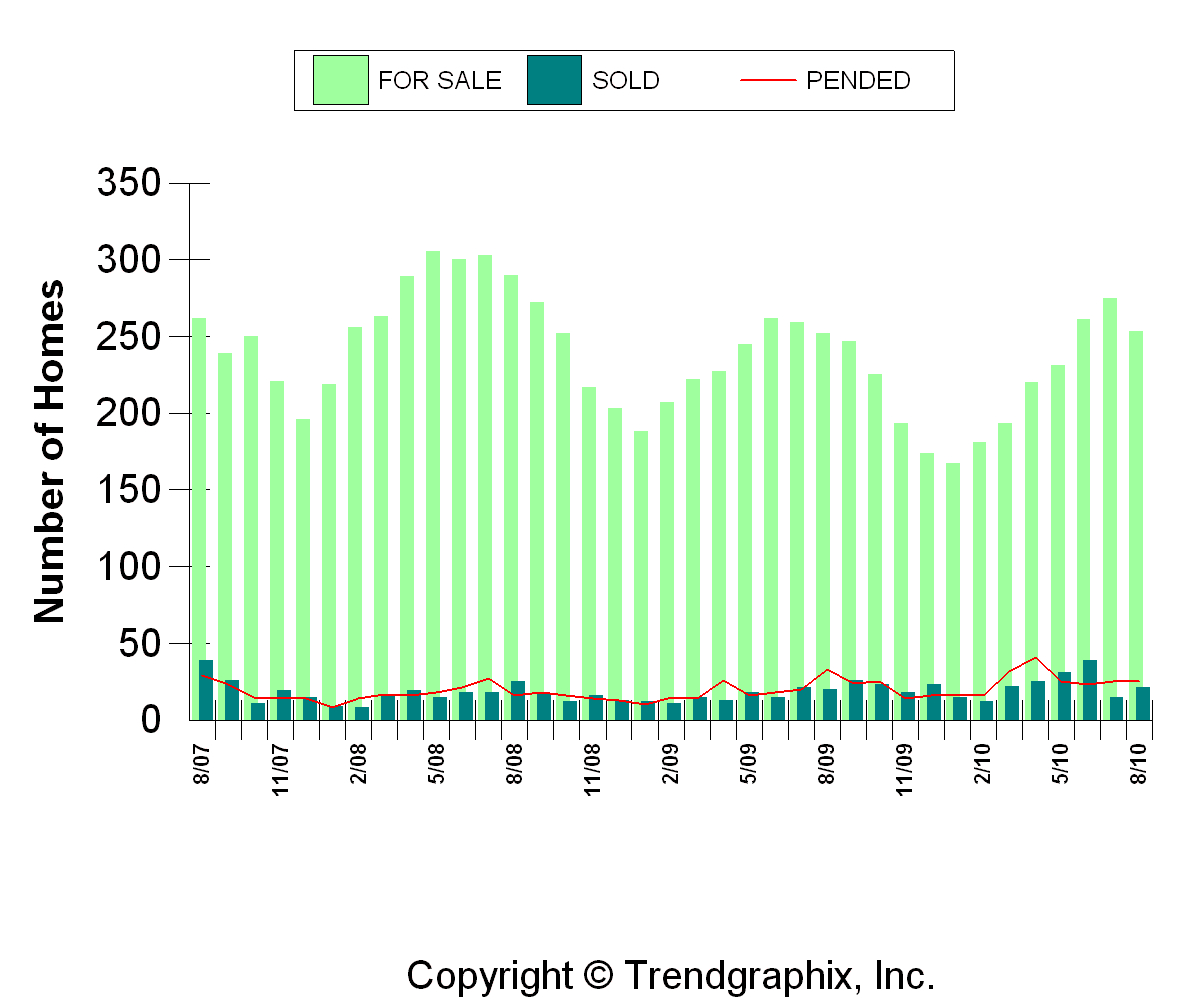

These graphs take a step back and look at the last three years. We are certainly on a downward trend in regards to price per square foot, but we see that irregular, erratic market at play through all of the seasons. Winter months like December of 2008 and January of […]

Do you like it?

September 8, 2010

September 8, 2010

Categories

One of the Best Things You Can do to Sell Your Home Here’s a piece from MSN Money that details the psychology of pricing and selling a home. The piece reiterates what I tell my clients when we sit down for a listing presentation. Buffer Pricing “You’re selling your home. Here’s […]

Do you like it?

September 3, 2010

September 3, 2010

Categories

The seemingly endless run of bad housing news is discouraging some potential home buyers from considering a purchase. But the truth is that the advantages of homeownership have very little to do with investment gains. The best things about owning a home have a lot more to do with personal […]

Do you like it?